Okappy is an online communications and workforce management platform which helps you manage your work, whether done by employees or subcontractors. Not only does it provide transparency and control, it can also be used to improve the cash flow of your business. Here’s 5 reasons how:

1. Improved invoice turnaround

With traditional paperwork systems, companies are often left waiting for certain details from a particular individual, such as a signature on a job sheet before the invoice can be processed and sent. Often this paperwork can go missing along the chain – meaning that the process has to start all over again! With Okappy, invoices can be sent straight away from the job desktop dashboard upon confirmation of the completion of a job. This helps you get your invoice paid faster, ensuring no payments are forgotten.

“The turnaround time from accepting a job to invoicing it is now a lot quicker. Before Okappy, raising an invoice could take weeks. Now we invoice minutes after the job has been completed. Since the job details complete with signature are instantly available, any invoice queries can be instantly answered by anyone with system access, levels of access can be set as required.” – Clare, Accounts at RPS.

2. Only do work for those companies that have paid their bills

With late payments endemic and the risk of company bankruptcies looming large. You don’t want to do work for companies that might never pay. With Okappy you’re alerted if you add a job for a customer with unpaid invoices.

- Adding a Job

As you add a New Job for a customer you can quickly see the outstanding balance for that customer. This means you will be more aware of when payments are behind, so you can decide whether you want to do the job before the customer has settled the balance.

- Reports

You can run a report for outstanding invoices for particular customers over a period of time. This way you can make better decisions about whether you want to continue to add jobs for customers with outstanding payments; allowing you to plan ahead and budget accordingly.

3. Integrations with other systems

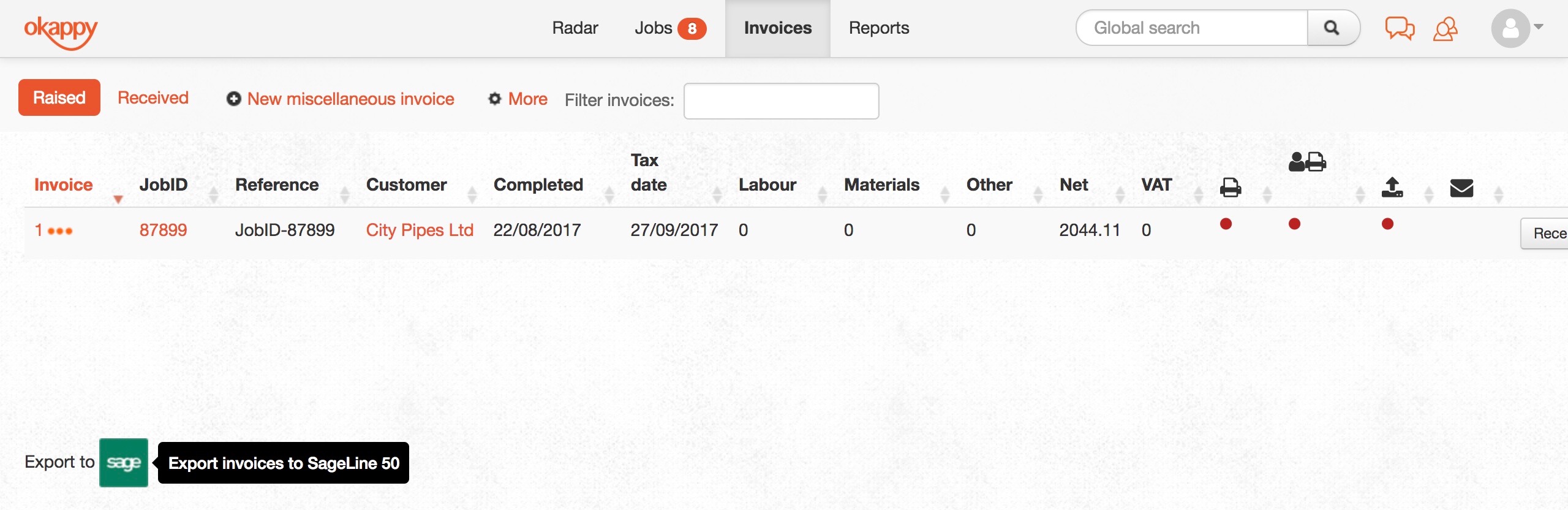

Okappy works with a number of other system including popular accounting software.

You can easily export your invoices into your accounting software saving you from duplicating your data from one system to another; thus saving you time. You can run various reports from your accounting software for example a cash flow statement, P&L report and aged debtors report etc. This allows you to get a comprehensive view of the financial position of the company. Looking at the data can help you analyse your expenditure and make better budgeting decisions for the months ahead. With some accounting software, such as Xero, you can even view financial information on-the-go on your smartphone.

4. Increased transparency

One of the main benefits of using Okappy to improve cash flow is that all the data for jobs, invoices and payments are logged into one secure system. This can be accessed anywhere and anytime to yourself and your customers. This reduces job sheets getting misplaced or lost, and also means no more missed invoices! With everything being logged onto the system there is more accountability surrounding payments and cash.

5. Improved efficiency around job scheduling

The job scheduler allows you to allocate reactive work to your engineers more efficiently. The location tracking software means you can see what engineers are closest to a job in order to allocate in the most cost-effective way – saving you more money on travel expenses.

For more tips on how Okappy can be used to improve cash flow check out our blog posts:

Leave your email below to stay up to date with our latest tips, tricks and trends on all things business?